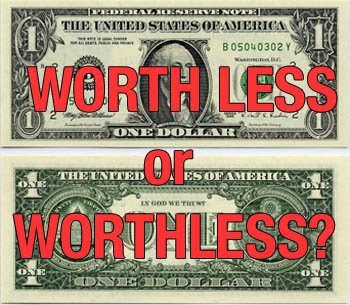

Every day I watch in fascinated horror as the value of my American dollars which I take out of the ATM Machines here in France dwindles. As of today, the value of one US Dollar is a mere 49 centimes. Back in the 90's, the dollar was worth something! I remember when my dollars were worth about 1,30 Euros. When the Euro was first introduced, the Euro and the dollar were fairly equal in value.

Now, the news here always has features of French tourists in New York shopping. Yes, the cost of living is dramatically rising here as well. The big news story of the week is the astromnomical rise in food prices in the last year. For name brands, the price has increased as much as 48%.

We pay a lot more for fuel because of taxes. It is sold by the liter and would probably work out to over 6 dollars a gallon with the present adjustment for exchange.

But in the USA, I read that the price for regular gas will hit $4.00 a gallon this spring! This must be affecting all of those who actuually have to deal with thinking about the cost of things. In other words, the middle class and the poor.

I really wonder what is behind the strategy of the Federal Reserve Board? Today I read a piece about Republican Congressman Ron Paul commenting to Ben Bernake, the Chairman of the federal Reserve.

In the article, Congressman Ron Paul slammed Federal Reserve chairman Ben Bernanke during a House Financial Services Committee meeting yesterday for following a policy of deliberately destroying the dollar and wiping out the American middle class.

Paul held Bernanke to task over his refusal to address the decline of the dollar and its clear link to inflation.

"Inflation comes from the unwise increase in the supply of money credit....to argue that we can continue to debase the currency, which is really the policy of that you're following, purposely debasing value of currency - which to me seems so destructive....it just puts more pressure on the federal reserve to create capital out of thin air in order to stimulate the economy and usually that just goes into mal-investment," said Paul.

Paul highlighted the fact that the M3 money supply was rising at a rate of 16 per cent and that this was the real rate of inflation.

"History is against you," Paul told Bernanke, "History is on the side of hard money - if you look at stable prices you have to look at the only historic sound money that's lasted more than a few years - fiat money always ends, gold is the only thing where you get stable prices," he added, pointing out that despite the price of oil's rapid ascent, it had remained flat when compared to the price of gold.

"I cannot see how we can continue to accept the policy of deliberately destroying the value of money as an economic value," said Paul, adding that the policy was "immoral," and would lead to a reduction in American's living standards and "the middle class being wiped out."

Asked how he could defend a policy of deliberately depreciating the dollar, Bernanke stumbled through his response and was basically forced to agree with Paul's point.

Paul's comments came on the day that the dollar hit its all time low against the Euro.

Earlier this week, former Fed chairman Alan Greenspan laid the groundwork for the further collapse of the greenback by encouraging Gulf states to abandon their dollar peg.

No comments:

Post a Comment